AACUC African American Credit Union Hall of Fame

2025 Honorees

Individuals of the credit union industry are honored by their peers for their distinguished contributions to the credit union community. The 2025 Hall of Fame inductions include five (5) credit union notables:

- Tony LaDarryl Black, Sr. (posthumously), President/CEO, Baylor College of Medicine Federal Credit Union

- Barbara J. Leonard (posthumously), Board Chair, Unitus Community Credit Union

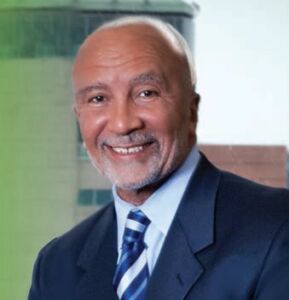

- Harold Roundtree, President/CEO, UNCLE Credit Union

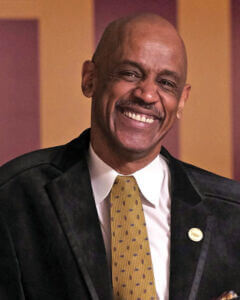

- Girado Smith, President/CEO, Educational Systems Federal Credit Union

- Pearl Wicks, Chief Retail Officer, Hope Credit Union

Our Mission

The African-American Credit Union Coalition (AACUC) was created to increase the strength of the global credit union community. We are a non-profit 501(c)3 organization of African-American professionals and volunteers in the credit union industry.

The AACUC Hall of Fame website is a way to raise funds for the organization to continue its mission and to identify African Americans and other minorities instrumental in making changes in our communities.

Charles Alston, Sr.

Pier Alsup

Tim Anderson

A. "Paddy" A. Bailey

Anthony P. Bailey

Tony LaDarryl Black, Sr.

Jim Blaine

Sandra DeVoe Bland

Gloria Bowden

Herbert Bowman

Marshall Boutwell

John Bratsakis

Dawn White Brewer

Rosemary Brinkley

Carolyn Adele Brooks

Gerald S. Brooks

Willie Bryant, DDS

William "Bill" Bynum

Robert Coleman

Dr. Birdex Copeland, Jr.

Pete Crear

Maurice Dawkins

Carla Decker

Isaac B. Dickson, Jr.

Melinda Edmunds

Melvin R. Edwards

Delores Glover

Anthony R. Grant

Michael Hale

Clarence Hall, Jr.

Bob Harvey

Bert J. Hash, Jr.

Rita Haynes

Todd Harper

Pamelya Herndon

Rodney E. Hood

Hubert H. Hoosman, Jr.

Senator Robert Jackson

Shirley Jenkins

Adrian S. Johnson

Lois Kitsch

Tony Kitt

Barbara J. Leonard

Don Lewis

Andre Lucas

Karen Madry

Cathie Mahon

Marsha Majors

Dan McCue

Janet McDonald

Mike Mercer

Sheilah Montgomery

Albert Maurice Moody

Jackie Moore

Joan Nelson

Gary A. Officer

George Ombado

Pamela Owens

Peggy Peacock

John Pembroke

William "Bill" Porter

Ed Presnell

Lillian Priest

Goldie Randall

Michael Ray

Clifford N. Rosenthal

Harold Roundtree

Victor F. Russell

Louisiana Sanders

Larry D. Sewell

Girado Smith

Lynette Smith

Maurice R. Smith

Barbara Stephens

Anthony Taylor

Robert "Bob" Trunzo

Donald Tynes, Sr.

Annie Wilma Vamper

Robert L. Watson, Sr.

Pearl Wicks

Herman Williams

Inducted March 2019

Charles N. Alston, Sr. has been a volunteer of Aberdeen Proving Ground Federal Credit Union for 30 years. He currently serves on its board of directors and as chairman of the credit appeals committee. During his tenure, the credit union has grown from approximately $175 million in assets and 42,500 members in 1988 to over $1.3 billion in assets and 130,000 members in 2018. Mr. Alston attributes the credit union’s success to its commitment to the People Helping People philosophy, and its commitment to the community. APGFCU supports hundreds of organizations throughout the communities it serves both financially and through volunteer time.

In 1993, Mr. Alston led the effort to create a local chapter of Habitat for Humanity in the credit union’s field of membership. In its 25-year history, Habitat for Humanity Susquehanna has completed over 100 construction projects and has served more than 700 families through its homeownership, repair and financial literacy programs.

During his employment, he served as a senior research analyst with the office of the Technical Director, Army Material System Analysis Activity (AMSAA). He was instrumental in laying the foundation for a multi-agency task force for the recruitment of minorities for the scientist and engineer career fields. This program received high acclaim from the U.S. Army and Material Command, as well as the Baltimore Federal Executive Board.

Charles is a life member of the Omega Psi Phi Fraternity. He is also the co-founder of the Iota Nu Chapter of Harford and Cecil Counties. The chapter supports the community by providing scholarships and tutoring services at the Boys and Girls Clubs. An active member of Mt. Zion Baptist Church, Charles serves as a deacon, chairman of the Budget and Finance Committee, advisor to the Scholarship Committee, and a Sunday school teacher.

Charles has been married to Mildred Hayes Alston for 54 years. They are parents of two children: Alicia, wife to Lt. Colonel (retired) Donald Harrison, and Charles N. Alston, Jr., husband of Renee Wilson Alston. Charles and Mildred are the proud grandparents of Isaiah Charles Alston.

Inducted February 2021

Pier Yvette Alsup is the Chief Diversity, Equity, and Inclusion (DEI) Officer for Together Credit Union (formally, Anheuser-Busch Employees’ Credit Union). In March 2021, Pier celebrated her 31st anniversary with the Credit Union. As Chief DEI Officer, Pier leads the Credit Union’s commitment to an equitable, inclusive work environment where diversity is celebrated, valued, and enriches personal and organizational growth. She is responsible for designing initiatives to identify inequities within the organization, fostering an inclusive and engaging culture, and developing and facilitating learning opportunities. Pier leads Together Credit Union’s DEI Council as its founding member. Formed in 2018, the Council is comprised of diverse employees from all levels of the organization as well as a member of the Credit Union’s Board of Directors. The Council’s mission is to empower its members to serve as thought leaders and champions in the advancement of the Credit Union’s commitment to diversity, equity, and inclusion. Additionally, Pier is the executive sponsor of the Credit Union’s Employee Resource Groups.

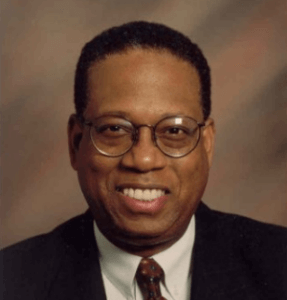

Inducted February 2024

Timothy L. Anderson has a long history with the United States Senate Federal Credit Union (USSFCU), serving as the EVP and Chief Retail Officer prior to assuming the role of President and CEO in 2019. He served on the USSFCU Board of Directors for over fifteen years in various capacities, including as Chairman of the Board. He began his career with USSFCU as the Branch Manager of the flagship Hart Senate location.

Tim possesses over 30 years of senior executive and management experience at large banks and credit unions. He was the CEO of a local credit union in Washington, DC; a position he held for eight years prior to becoming EVP at USSFCU. Other positions include VP and COO at American Spirit Federal Credit Union; VP and COO at the Treasury Department Federal Credit Union; VP of Operations at Equitable and Independence Banks; and Assistant VP and Financial Center Manager at BB&T and M&T banks in the Washington, DC area.

Tim has expansive professional experience. He has served as an Engagement Advisory Member at the Credit Union National Association (CUNA) and is a current member on the Board of Directors for the Maryland & DC Credit Union Association (MDDCCUA). He serves as a member on the Board of Directors and past Chairman for the African American Credit Union Coalition (AACUC). He is past Chairman of USSFCU’s wholly owned CUSO, Credit Union Strategic Services, which focuses on business loan participations.

Tim received his M.B.A. from the University of Maryland, University College and serves this institution as an Adjunct Professor in the Finance and Economics Department.

Inducted February 2016

For nearly five decades the name of A.A. “Paddy” Bailey was synonymous with international savings and credit cooperative development. A true visionary, Bailey dedicated himself to the promotion of co-ops, in particular credit unions.

Bailey started as an inspector of co-ops in Jamaica, becoming the leading organizer of credit unions there. He joined CUNA International in the 1950s, rising to become executive director of its World Extension Department. While at CUNA Bailey was responsible for the development of credit union leagues throughout the West Indies and the formation of the first regional credit union organization. His talents and enthusiasm for co-op philosophy were later applied in Africa, where he helped to found the African Confederation of Cooperative Savings and Credit Associations.

Bailey became the first full-time managing director of the World Council of Credit Unions in 1975, where he continued to be an innovative leader and co-op advocate.

Through his career and throughout his life, Bailey has been instrumental in spreading the word about the value of cooperation, and developing many new credit unions, credit union leagues and other institutions.

Inducted February 2021

Anthony P. Bailey, Vice President, Pepco Federal Credit has been in the credit union industry for 39 years. I began working in member services and moved to the accounting department thus progressing to my current position.

Always a reader I came across AACUC in a credit union publication and joined immediately and that began my journey. I planned to attend my first annual conference in 2004 and with the sudden death of my mother I was not able to attend. Then in 2005 I was able to attend my first conference and has attended every year since then except for 2016 because of a health issue. I have been totally impressed with organization especially the educational benefit and the philosophy. I served on the planning committee for the Eastern Regional Chapter. I served as treasurer for many years and attended regular meetings.

While being employed I have always believed in advancement, thus hiring individuals that showed great potential and many have gained great positions.

I am really looking forward to the future of AACUC and all of its success.

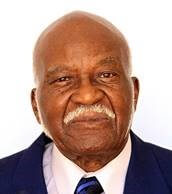

Inducted February 2025

Tony LaDarryl Black, Sr., was a dedicated leader, beginning his finance career in 1983 as a collections and loan officer at United Gas and Pipeline Federal Credit Union in Houston, TX. He was quickly promoted to Associate Manager of Energy Employees Credit Union, before ultimately joining Baylor College of Medicine Federal Credit Union in 1997. For over 25 years, he served as the President and CEO of Baylor College of Medicine Federal Credit Union, providing invaluable financial services to its members across the Greater Houston area. His unwavering commitment to excellence and genuine care for others earned him deep respect and admiration from both colleagues and clients.

Black’s significant contributions to his community included remaining an active member of the AACUC for more than 20 years and serving as the Texas Regional Chapter Secretary. He was a member of the Cornerstone Resources Board of Directors and contributed his expertise to the Houston Chapter of Credit Unions’ Audit Committee. Throughout his career, he regularly participated in CEO Roundtable discussions and engaged in Houston chapter meetings.

Black’s love for the arts was prominent throughout his life with his commitment to serving as Treasurer for the Ensemble Theatre Board of Directors for over a decade. He also possessed a passion for nurturing young minds in underserved communities. He was a successful business owner for over 20 years, operating two childcare facilities.

He held a Bachelor of Science in Business and Commerce and a Master of Business Administration from the University of Houston.

Inducted February 2021

Jim Blaine lives in the woods in rural North Carolina. He is slightly balding, can be testy, is not getting thinner, has been known to argue and has at least one opinion on everything. Jim thinks he can dance, but he really can’t; likes most people and all dogs. He is a graduate of UNC-Chapel Hill, holds an MBA from Duke University and is also a CPA (inactive). Jim worked with the State Employees’ Credit Union and while employed served unsuccessfully on numerous boards and committees. Much to his relief and to the relief of his fellow committee colleagues, he was rarely re-elected and never reappointed.

Jim has been married to Jean Burdette Blaine for 45 years. Jean is an individual of exceptional patience. They have five adult children - Jim, Eleanor, Sarah, Thomas, and Mary - and a small swarm of grandchildren. His grandchildren call him “Sweetbaby", but they are still too young to know better.

He currently tends chickens and raises daffodils, while retaining an active interest in provocation and inspiration. He is developing a fondness for champagne.

Inducted August 2019

Sandra DeVoe Bland, a distinguished professional with over 35 years of leadership, management, engineering, and technical experience at the Savannah River Site (SRS), is the first female and African American Chairman of SRP Federal Credit Union’s Board of Directors. She holds a Bachelor of Science in Chemical Engineering from Georgia Tech and a master's degree in project management from Keller Graduate School of Management. She has over 27 years of SRP FCU board experience, mastering governance and consultative leadership utilizing strategic thought to execute her duties. She is employed by Savannah River Nuclear Solutions, the Management and Operations Contractor for SRS. Sandra is also the founder of S. J. DEVOE & Associates.

As SRP FCU Board Chairman, Ms. DeVoe Bland has contributed to and ensured the financial safety and soundness of SRP. She has led the Board through rapid growth, the challenges of the Covid-19 pandemic and leadership transitions. This is evidenced by SRP’s stellar performance trend and delivery of solid results. Focusing on setting strategic direction and amplifying members’ voices, Ms. DeVoe Bland embodies servant leadership, reinforcing SRP’s commitment to its membership, communities, and “people helping people.”

Beyond her board duties, Ms. DeVoe Bland is deeply committed to promoting financial literacy and stewardship within the community and throughout the southeast. She builds high performing teams and inspires others. She is actively involved in teaching financial education, champions the credit union movement, and advocates for members’ interests.

With her unwavering dedication and inspiring leadership, Sandra DeVoe Bland ensures a brighter future for all those she serves.

Inducted August 2022

Gloria V. Bowden began her 52-year history with Democracy Federal Credit Union in 1969 (then named HEW Employees Federal Credit Union) as a Loan Assistant and Membership Officer. Her strong work ethic and passion for learning carried her up the corporate ladder, first to Assistant Treasurer, then VP/SVP of Member Services, and finally to Executive Vice President and COO. Although she was more than capable, she repeatedly declined offers to become CEO over the years, preferring to be a strong support to the leadership team and all staff. Among her many important achievements, she presided over both the new charter that brought in all of residents of DC in 2003 and over the name change from HEW to Democracy in 2015. She also was actively involved in the MD/DC Credit Union Association’s advocacy efforts. But ultimately, she was the glue that held things together at Democracy FCU. She was well-loved and respected by so many over the years spending countless hours with her staff; coaching, developing, mentoring, encouraging, and holding them to a higher standard. Every one of her employees would tell you that she had a gift for being honest and holding them accountable with the utmost compassion and kindness. Members of DFCU have shared endless fond memories of how she took time with them, personally cared about them, saved them and their family from financial ruins, giving them a chance at a better future.

Equally near and dear to Mrs. Bowden was her place of worship, Varick Memorial AME Zion Church in Washington, DC which she joined over 50 years ago; a steadfast member extremely dedicated to her church family and deeply rooted in their ministries. Her involvement in every aspect of Varick’s ministries lead her to become a Preacher’s Steward Deaconess, Chair President/Member and Class Leader. In all, she made her mark as a faithful servant to each and every pastor at Varick AME Zion Church. Giving her time, talent, and treasure ensuring that the clergy and their families were provided for as well as anybody coming through those church doors that had a need. She is called “Sister” and “Mother” by so many in the Varick and River Terrace communities and she had a gift for making each person feel as if they were the most special person in the world because she truly believed that.

Even outside of her church community, Mrs. Bowden generously gave of her time and treasure to local and national organizations. Among some of her contributions are: Advisory Neighborhood Commission; Chair of the Finance Committee at Nonprofit Ministry; Cherry Blossom Race; Volunteer for Children’s Miracle Network; Food and Clothing Bank for the Needy; Mentor Program for Teens and Young Mothers; 900 Lunches for the Community – Program Set-up for the Hungry; Roblee Community Association; Summer Programs for Youth and Young Adults; The Power Company Kids Club; Toy Bears for Children’s Hospital.

In her spare moments, Mrs. Bowden loved gardening, enjoying the unique and beautiful birds in her backyard, fishing and traveling with family.

Inducted February 2020

“Work hard. Be true to yourself. Take responsibility.

Have a positive outlook. Expect the best from people.”

-Herbert “Bertie” Bowman

These are the beliefs that Bertie Bowman lives by and the values that have served him well throughout his life and career.

Arriving in the nation's capital in 1944, Bertie Bowman is the longest-serving African-American staff member on Capitol Hill. From sweeping the steps to working in the coffee shop and the Capitol barbershop—Bowman held several jobs in the Senate, ultimately rising to become assistant hearing coordinator for the U.S. Senate's Foreign Relations Committee, one of the most powerful committees in Congress.

Herbert "Bertie" Bowman was born in the small town of Summerton, South Carolina, in 1931. His precise birth date uncertain, Bowman believes he was born April 12, 1931.

A 12-year-old Bowman met Senator Burnet R. Maybank, while he was campaigning for re-election outside a local store. Maybank addressed the crowd as he was leaving and said “if you’re ever in Washington to come by and see me”. Bowman said, ‘If I come to Washington, D.C., can I come by and see you?’ The Senator replied “yes” and a year later Mr. Bowman left home and went to Washington.

Inducted July 2024

Marshall Boutwell was born in NC and grew up in a military family. He volunteered for the U.S. Army in 1967. During service in Vietnam, he was awarded the Distinguished Flying Cross, Bronze Star Medal, Purple Heart, 12 Air Medals, and the Vietnamese Cross of Gallantry. Boutwell completed his military service in 1972 then attended Campbell College.

Boutwell’s career in business management includes positions with several companies in the financial services industry. He began his credit union career as President/CEO at Peach State FCU in 1994. During his tenure, Peach State has grown from $14M to over $916M in total assets. The credit union serves 75,000+ members with 200+ employees and 26 branches in GA and SC.

Boutwell is a leader in the credit union movement and has served on numerous boards and committees. He is the recipient of the World Council of Credit Unions Distinguished Service Award, the Moses C. Davis Lifetime Achievement Award, and was inducted into the Credit Union House Hall of Leaders. Boutwell is also the recipient of the Knights Cross of the Order of Merit from the Republic of Poland and the Polish Credit Union Foundation “Feniks” Award for his support of Polish credit unions.

Inducted March 2024

John Bratsakis has been President and Chief Executive Officer of MD|DC Credit Union Association since 2011. His 35-year career in the credit union movement includes extensive experience in operations and advocacy. He served as Senior Vice President of Baxter Credit Union in Vernon Hills, Illinois; CEO of Community Trust Credit Union in Gurnee, Illinois; and held management positions with United Federal Credit Union in Michigan and Teachers Credit Union in Indiana. John is currently the Chair of CU4Kids, Credit Union Miracle Day and the Credit Union Cherry Blossom Ten Mile Run. He also serves on the American Association of Credit Union Leagues (AACUL) Executive Committee as Secretary/Treasurer and as Board Member for CU Risk Intelligence, League InfoSight, and Plexcity a back-office company for associations.

Inducted August 2021

Dawn Brewer says that service is woven into her DNA. For her, that means making a positive difference in whatever she does.

She has been in financial services for 30+ years. She is an avid volunteer for multiple organizations and churches. She began her career with a small community bank in Burlington, NJ, and went on to work for other financial institutions before relocating to Atlanta and starting a 21-year career at Coca-Cola Credit Union. Dawn began as a teller, worked in various departments and rose to VP of Marketing consistently winning awards and accolades before retiring in 2017.

She has worked tirelessly for AACUC in many volunteer capacities and became the Director of Membership. She mentored 7 interns over the span of the program at Coca-Cola Credit Union with 3 progressing on to become permanent employees. Volunteering at the Boys and Girls Clubs teaching financial literacy and mentoring others for several years are some of her fondest memories working in financial services.

A cancer survivor with a zest for life, she continues to make lasting memories with her husband, blended family of 6 children, 15 grandchildren, and a host of family and friends on this wonderful journey called Life!

Inducted August 2016

Educational Systems Federal Credit Union in Greenbelt, Md. for more than 50 years, she served for 46 years on the board of directors. During her service, Brinkley held the offices of treasurer, vice chair and chair for the past 20 years.

Under her leadership on the board, Educational Systems FCU grew from serving several thousand members in one Maryland county to more than 87,000 members in seven counties throughout the state.

Brinkley received her undergraduate degree from Hampton University and her master’s degree from New York University.

During her 33-year career in education, she was an educator with Charles County Public Schools and later became an educator and administrator in Prince George’s County Public Schools. As an educator, Brinkley enjoyed teaching business classes and was a life-long supporter of financial education.

“Rosemary always led with her mantra of ‘We can do better.’ She was a true champion of education and credit unions,” Chris Conway, president/CEO of Educational Systems FCU, said. “Our credit union family is deeply saddened by her passing on October 21, 2016.”

Inducted August 2018

Carolyn has been a member and a volunteer at SecurityPlus FCU through its incarnation (SSA Baltimore Federal Credit Union) since 1971. She attended Hampton University and graduated with a Bachelor of Arts Degree in Mathematics and an M.A. in Mathematics from Morgan State University f/k/a Morgan State College. Carolyn is a lifetime member of the Morgan State Alumni Association.

She was previously employed with the Social Security Administration where she served for over thirty-eight years and was promoted to Deputy Division Director upon her retirement. Carolyn has been an active member of the Delta Sigma Theta Sorority (DST) since 1966. She is an avid church member who loves the Lord and loves to serve people. She currently serves as the treasurer of her church.

Carolyn served as the First Black Female on the Board of Directors of the former SSA Baltimore Federal Credit Union and also served as the First Black Female President of the Credit Union.

Inducted February 2021

Gerald S. Brooks is a retired Marketing, Public and Community Relations Director for the St. Louis Public Library where he worked for 24 years.

In his first twenty-two years, he oversaw the day-to-day operations of the Marketing Department and supervised all aspects of the Library's public relations, media relations, special events, advertising, printing, design, writing, photography, and community relations. He worked closely with the media, other non-profit organizations, and the corporate community to increase public awareness of the Library's services, and create sponsorships that enhance the Library's ability to serve St. Louis.

In his last two years, he helped create a department that worked collaboratively with Library staff and community partners to develop system-wide innovative programming that served the diverse needs of the community and that was consistent with the mission and strategic goals of the Library. He oversaw staff responsible for all aspects of public programming, exhibitions, volunteers, and special events including planning, implementations, and logistics. In addition, he supervised the management of the Library’s meeting rooms and the programming and event space in Central Library. He worked closely with the Marketing and Technology Departments to promote Library programs and events. He was also responsible for establishing partnerships and sponsorships of Library programming initiatives.

He was a member of the Library's senior management team, the media liaison and an official spokesperson for the Library.

Before coming to work for the Library, Mr. Brooks spent twenty-one years in various capacities with the McDonnell Douglas Corporation, rising from mailroom clerk to Corporate Advertising Coordinator. After corporate downsizing, he was laid off and went to work for the Missouri Historical Society in the development department. He worked there for one year before taking the job at the Library.

Mr. Brooks (a native of St. Louis), has been active in the St. Louis community for the last five decades. He was a member of the Leadership St. Louis class of 1995-96 and has served on a number of Boards and committees. He currently serves on the Boards of the St. Louis Community Credit Union (Chairman), the African Heritage Association of St. Louis, Inc. (Chairman), the St. Louis Society for the Blind and Visually Impaired (Chairman 2005 & 2006) (Minority Advisory Board, Chairman) and the Friends of the Missouri Governor’s Mansion. He also serves on the Gala committee for Habitat for Humanity St. Charles County and the Legislative committee for the Missouri Library Association.

For his many community efforts and contributions, Mr. Brooks was listed repeatedly in Who's Who in Black St. Louis. He has also been honored with various awards including the St. Louis Sentinel Yes, I Can Award; the Mathews-Dickey Alumni Award for Community Service and Contributions made to youth; the Missouri Black Expo/University of Missouri-Columbia Unsung Hero Award; the North Side Preservation Commission Award and the Fair St. Louis Mel Loewenstein Distinguished Volunteer Service Award. In addition, he has been recognized with plaques and certificates of appreciation from various organizations including: the Delta Gama Center; Ames School; St. Louis Community Credit Union; Gravois Business Improvement District; Williams Middle School; African Arts Festival; St. Louis Public Schools Role Model Program; Blewett Middle School; Majic 104.9 Radio; The Urban League Adult Basic Education Program and the Department of the Army Personnel Center.

He is also profiled in best-selling author Gail Sheehy’s book Understanding Men’s Passages, a contributing author to Missouri Libraries Your Lifetime Connection, a marketing manual for Missouri Library staff and trustees and a contributing author to Family Affair: What It Means to Be African American Today, a book of essays by Gil L. Robertson, IV.

He is a current member of the Missouri Library Association (MLA) (President 2014), the African-American Credit Union Coalition (AACUC), the Mathews-Dickey Boys and Girls Club (Alumni 1968) and FOCUS St. Louis.

For more than twenty years before retiring, he participated in the St. Louis Public Schools' Career Role Model Program by visiting city schools to share his experiences with children.

In 1999 he was appointed by the State Librarian to the Missouri Library Marketing Task Force and chosen as a member of the Missouri Legislative Committee for Libraries in 2001, where continues to serve today.

Mr. Brooks holds a bachelor's degree in business administration from Tarkio College. He resides in St. Louis, Missouri, with his wife of 41 years. They have two daughters.

Inducted February 2020

Willie L. Bryant, Sr., DDS, was born in Goulds (Dade County), Florida to Claudia Mae Bryant and John Henry Ashley on October 6, 1938. This period marked the era of the Great Depression and Jim Crow. During this time, many families across the country were looking for work and trying to survive the harsh economic collapse that was on the horizon. The jobs that were available discriminated against people of African-American descent, leaving only a handful of jobs they were allowed to work. Dr. Bryant’s single, disabled mother had to work several domestic jobs to support her seven children, since their father did not offer any financial support despite their father’s success as a land owner in the Goulds’ community. His mother stressed the only way to escape their impoverished living conditions was through education.

Growing up in the Great Depression and Jim Crow South made it difficult to obtain an education. At various times, Dr. Bryant and his siblings worked as migratory workers selling fruits and vegetables to support the family. The Black educational system did not have the resources to adequately educate African-American youths as their white counterparts. Dr. Bryant and his siblings matriculated through primary school as their mother required all of them to verbally explain the thinking behind their daily completed homework assignments. Ms. Claudia Bryant never revealed to her children that she did not complete her high school education. Dr. Bryant would go on to graduate second in his class from Mays High School in Goulds. After graduation from high school, Dr. Bryant continued and finished his education at Florida A&M University (FAMU) in 1961. After graduation from FAMU, he served as an officer in the United States Army. While in the Army, he endured many hardships and experienced racial inequality. Dr. Bryant used military benefits to further his education. He graduated from Howard University’s School of Dentistry. Dr. Bryant remained involved in both universities’ alumni associations. He served as FAMU Alumni Association’s Chapter President and the Northeast Regional Vice President, before he became the president of the Ossining Howard University alumni branch where he began a sickle cell anemia screening project that reached over 1,200 individuals.

Inducted March 2015

Mr. William “Bill” Bynum serves as Chief Executive Officer and President at Hope Community Credit Union and Hope Enterprise Corporation. Mr. Bynum is responsible for the strategic direction of Enterprise Corporation of the Delta and its affiliate companies. He has eighteen years of experience with some of the country's leading development finance and rural development finance programs. For three decades, Bill has worked to advance economic opportunity for disenfranchised populations. He began his professional career by helping to establish Self-Help, a pioneer in the development finance industry, and later built nationally recognized programs at the North Carolina Rural Economic Development Center. He moved to Jackson in 1994 to become the founding CEO of the Enterprise Corporation of the Delta and in 1995 organized Hope Credit Union.

Today HOPE (Hope Enterprise Corporation/Hope Credit Union) is a regional community development financial institution, intermediary, and policy center that provides and promotes responsible financial services and related assistance for entrepreneurs, home buyers, and community development projects in distressed communities across Arkansas, Louisiana, Mississippi, and Tennessee. Bill has advised Presidents Clinton, Bush, and Obama on community development, small business, and financial service matters, serving for ten years as a presidential appointee and chairman of the Treasury Department's Community Development Advisory Board.

He has been Vice Chairman of Consumer Advisory Board at Consumer Financial Protection Bureau since September 13, 2012.

Mr. Bynum serves as Director at AmSouth Community Development Corporation, Regions Bank Community Development Corporation, the Compatible Ventures Group, Corporation for Enterprise Development, Hope Community Credit Union, the New Markets Equity Fund and Southern Development Bancorporation. He served on the board of the North Carolina Technological Development Authority, a state-sponsored venture capital fund. He serves on the boards of Foundation for the Mid South, Mississippi Childrens Museum, Partners for the Common Good, Winthrop Rockefeller Foundation, on the Mississippi Access to Justice Commission, and is Chairman of the President Community Development Advisory Board.

Mr. Bynum is Henry Crown Fellow of the Aspen Institute and was named 2002 National Supporter of Entrepreneurship by Ernst & Young and the Kauffman Foundation, and the 2007 Annie Vamper Award recipient by the National Federation of Community Development Credit Unions. Mr. Bynum is University of North Carolina graduate.

Inducted August 2016

Robert L. Coleman, Jr., is a graduate of Prairie View A&M University, Mr. Coleman worked for 13 years as a professional engineer before becoming employed by the U. S. Government Office of Personnel Management, where he served for 35 years until retirement.

Mr. Coleman contributed to the credit union movement in a number of positions including President/CEO at Northwest Baptist Church FCU and Interim President/CEO of Waterfront Federal Credit Union. He was instrumental in establishing the Youth Outreach Association at the Northwest Baptist FCU and served as Chair of the Youth Advisory Committee of the National Federation of Community Development Credit Unions. He was the 2000 recipient for the Annie Vamper Helping Hands Award from the National Federation for Community Development Credit Unions.

In 1958, Mount Zion Baptist Church, one of Seattle’s oldest African-American churches, set up a credit union to serve members of its congregation. The idea was that a church-based lender could better serve church members. At the time, many African Americans had trouble doing business with traditional banks and credit unions, due to racism or lack of credit or both.

On Monday, September 1, 2015, the Board of Directors and CEO of Northwest Baptist Federal Credit Union made a decision to pursue a merger opportunity with Seattle Metropolitan Credit Union (SMCU), another local not‐for-profit financial cooperative headquartered in Downtown Seattle. The decision to merge with SMCU was made in an effort to provide a significant expansion in services and facilities to our members. Robert Coleman relocated to SMCU’s Downtown Seattle Headquarters.

In the nearly 50 years since then, the credit union strayed very little from its historical mission…offering a handful of products, primarily savings accounts, auto, and home equity loans, to members of Mount Zion and the surrounding community in Seattle’s Central District.

Inducted February 2016

Dr. Birdex Copeland, President, is retired from Grambling State University. Prior to his retirement, he was a teacher and administrator for thirty-four years. He served as Head of the Department of Sociology and the Dean of the School of Social Work. Dr. Copeland holds a Bachelor of Arts degree from Grambling State University, a Master of Social Work degree from Atlanta University, and the Doctor of Philosophy from Kansas State University. He is Dean Emeritus of the School of Social Work, Grambling State University.

He is also a former Chairman of the Board of Directors of Shreveport Federal Credit Union, Chairman of the Grambling Legends Square Taxing District, a member of the Grambling Economic Development Council, a former City Councilman, and a Deacon of the Mount Olive Baptist Church of Grambling.

Dr. Copeland has served the credit union movement as a volunteer for over 40 years. He considers his efforts toward the “people helping people” emphasis in the credit union movement as an extension of his professional role as a social worker. Serving the “underserved” is an important mission.

A visionary and a leader, Dr. Copeland, led the credit union as it adopted a successful Community Development Strategy serving Low to Moderate Income people across two of the most distressed states, Louisiana and Mississippi.

Dr. Copeland is a huge advocate for the credit union movement and a true believer that a board must be trained, must be knowledgeable of credit union compliance and current events and must plan for the future.

Married to Lolita Collins-Copeland, Dr. Copeland is the father of two children and grandfather of two.

Inducted February 2016

Retired President/CEO of World Council of Credit Unions. Under Crear’s leadership, WOCCU significantly expanded not only its membership but also its influence in credit union development worldwide.

WOCCU launched development programs in Ethiopia, Haiti, Peru, and other countries, as well as seeing its development program in Afghanistan grow significantly. During his tenure, WOCCU convened its first technical congresses to train credit union managers in Africa, Latin America, and the South Pacific.

WOCCU also launched the European Network of Credit Unions, the International Credit Union Regulators’ Network and the Global Women’s Leadership Network, a peer-to-peer and educational network that brings together women credit union leaders from both developed and developing countries.

In his six years at WOCCU’s helm, the organization successfully lobbied on behalf of member organizations in Costa Rica, Poland, and other countries, as well as helped foster the passage of credit union legislation in Kenya and Malawi. The organization also represented the global credit union movement before the United Nations, the Basel Committee on Banking Supervision, the International Accounting Standards Board and other international monetary organizations, successfully making the case for proper regulatory oversight on behalf of credit unions worldwide.

Prior to joining WOCCU, Crear was CUNA’s executive vice president of external relations and, before that, executive vice president and the chief operating officer responsible for daily operations of the Madison, WI offices. In his career, he is credited with organizing 23 credit unions in his home state of Michigan and served as the President and Chief Executive Officer of the Connecticut and Indiana Credit Union Leagues.

In 2008, the Foundation for Polish Credit Unions, part of the Polish credit union system, awarded Crear the Feniks Prize, the Polish system’s most prestigious award, for WOCCU’s work helping strengthen credit unions in Eastern Europe. In 2007, he earned the Michigan Credit Union League’s (MCUL) Distinguished Service Award and was inducted into the MCUL Hall of Fame. In 2006, the Consumer Federation of America awarded him the Esther Peterson Consumer Service Award.

Crear also received the African-American Credit Union Lifetime Achievement Award, which was subsequently named after him, and a college scholarship was established in his name. He was inducted into both the Credit Union Executives Society (CUES) Hall of Fame and the Cooperative Development Foundation Hall of Fame and received the National Credit Union Foundation Herb Wegner Lifetime Achievement Award, the U.S. credit union movement’s highest honor.

Inducted March 2024

In 2001, Maurice joined the team at American Spirit FCU, a 32-million-dollar credit union headquartered in Newark, DE. He was named American Spirit’s CEO in 2003. Under his leadership, American Spirit grew to $78 million in assets and expanded into the under-served area of Newark, Middletown and Dover, Delaware. American Spirit has been recognized as one of the top credit unions in the United States and received a Five-Star rating from Bauer Financial for its financial strength.

Maurice has over 30 years of operational leadership in the financial industry with a proven record in building diverse teams to support business growth while leading changes to drive organizational peak performance.

Maurice holds a Bachelor of Science in Accounting and a minor in Business Management from Thomas College in Waterville, Maine. In 2002 he received the Dale Carnegie Highest Award for Achievement and the AACUC Chairman’s award in 2016.

Maurice spent many years as an active supporter of credit unions throughout Delaware and the surrounding states, which demonstrates his dedication and commitment to the credit union industry.

He currently serves on the following boards: Member Business Financial Service CUSO, AACUC Eastern Regional Chapter, Cooperative Credit Union Association.

Inducted February 2023

Since November 2021, Carla Decker is Chief Operating Officer of IDB Global Federal Credit Union - a $700+ million, not-for-profit, financial service cooperative owned by over 10,000 members of the Inter-American Development Bank (IDB) and Inter-American Investment Corporation (IDB Invest). Residing on six continents and over 75 countries, the members (who form the IDB Community) seek to promote peace and reduce poverty in Latin America and the Caribbean through economic and social development.

For the previous two decades, Carla served as President & Chief Executive Officer of DC Federal Credit Union. Under her leadership, the $80 million DC Credit Union expanded its service area and refocused its mission to become a national leader in financial inclusion and community development. Carla’s immigrant experience informed and energized DC Credit Union’s initiatives to address and advocate for the financial well-being of the local Hispanic community. For that work, Carla was named one of the 100 Most Influential People to the Hispanic Community by “El Tiempo Latino”.

Carla is Chair of the Board of the National Cooperative Business Association (NCBA/CLUSA). She represents NCBA/CLUSA, and the U.S. cooperative movement, to Cooperatives of the Americas, the regional body of the International Cooperative Alliance.

She holds a master’s degree in International Commerce and Policy from George Mason University in Virginia.

Inducted March 2017

Isaac B. Dickson Jr., a native of Montgomery, AL, has been a resident of Spartanburg, SC since 1981. He spent nearly 30 years in the temporary employment industry as Vice President of The Hiring Authority, Inc. Professional memberships include the Society of Human Resource Management, Spartanburg Human Resource Association and the SC Association of Personnel Services.

Currently, Isaac is the Director of Marketing for Atchison Transportation Service, a full-service ground transportation service. In 1991, he was elected to the Board of Carolina Foothills Federal Credit Union in Spartanburg, SC. Later in 2004, he was elected as the Board Chairman. Isaac is the first African American to be elected to the Board.

Isaac’s leadership has been instrumental in creating a Board that represents the diversity of the membership including age, race, and gender. Isaac served as the Chairman of the South Carolina Credit Union League’s Diversity Committee and as a League Board member.

Isaac is also a founding member of the African-American Credit Union Coalition, serving as its first Secretary.

Other community activities include:

- Isaac is a graduate of Livingstone College and is married with one son.

- Member One Spartanburg Entrepreneurial Action Team

- Member Transitional Living Advisory Board Hope Center for Children

- Men’s Bible study / Fellowship Ministry

- Member Sparkle City Transparent Men, an interdenominational

- Member Board Habitat for Humanity

- President Kiwanis Club of Spartanburg

- Board member SC Workforce Initiative Board

- Chairman Board of Deacons St. Paul Missionary Baptist Church

Inducted February 2023

Melinda Edmunds is President/CEO of the Patent and Trademark Office Federal Credit Union headquartered in Alexandria, Virginia. With more than 30 years of credit union experience, her dedication, volunteerism, and leadership in the credit union movement continues to progress. She was a previous board member of AACUC for ten years and led the Membership Committee for several years. She is currently a Certified Credit Union Financial Counselor. Edmunds earned a Bachelor’s Degree in Psychology from North Carolina Agricultural and Technical State University.

Inducted March 2017

Melvin R. Edwards is known throughout the Caribbean Region and internationally for his outstanding contributions to enabling families and communities of low and average means to access affordable finance and to gain ownership of democratically controlled financial institutions.

Mr. Edwards is a devoted credit unionist and a former President (1995-1999) and Director (1991-2009) of the Caribbean Confederation of Credit Unions (CCCU). In July 2007, he was elected Chairman/President of the World Council of Credit Unions (WOCCU) and remains the first Caribbean national to serve in this esteemed position. In 2009, his completion of 2 terms as the WOCCU Chairman was the culmination of 11 unbroken years as a WOCCU Board Director having previously served as Vice Chairman, Treasurer and Secretary.

He led WOCCU with distinction, resulting in several strategic breakthroughs, increased visibility and strengthening as the global trade association and development agency for credit unions worldwide. He has lobbied Government leaders in Europe, Australia, Africa, North, Central and South America, and the Caribbean to implement enabling policies and standards-based legislative frameworks and to improve trade facilitation so that credit unions, co-operatives and small businesses can expand and flourish. The International Consumer Protection Principles for Credit Unions were approved under his lead as WOCCU Chair.

In 2009, he earned the Certified Credit Union Development Educator (CUDE) and the International CUDE (I-CUDE) designations, and in 2010 he introduced the Caribbean Development Education (CaribDE) Program to the Caribbean region. CaribDE focuses on empowering the human capital of the sector by raising the bar of knowledge, skills and passion required for tomorrow’s leaders to address developmental and managerial issues with competence. After six years of existence, 24 programs have been held across seven Caribbean countries and 763 persons from 21 countries (including Canada, the USA, Haiti and Kenya) have been certified as Caribbean Development Educators. Since 2013, CaribDE has been partnering with the USDE and the ACCUC in supporting the Africa DE program. In June 2017, CaribDE, in partnership with the Canadian Credit Union Association and St. Mary’s University, will be staging the first-ever Canada DE Program in Halifax, Nova Scotia.

As the Managing Director of Development Co-operators Incorporated – a Management, Finance and Competitiveness Consultancy, Edwards has successfully implemented several regional development initiatives on behalf of multilateral organizations including the World Bank, the Commonwealth Secretariat, the European Union and the Inter-American Development Bank. Mr. Edwards has held four Chief of Party positions with international development organizations managing major multi-country, private and public sector economic competitiveness initiatives that have benefited the Caribbean.

For his outstanding works in eco-systems transformation, access to finance and policy advocacy for the Caribbean, Edwards has been honored by the National Credit Union Foundation (NCUF), Caribbean Confederation of Credit Unions (CCCU), CUNA Caribbean Insurance Society, the Eastern Caribbean Organisation of Development Foundations (ECODEF) and the Jamaica Co-operative Credit Union League.

In 2013 he received the Distinguished Services Award (DSA) from WOCCU, for his lifetime of services to financial and other co-operatives worldwide and in 2014, in recognition of his exemplary work in development education, the United States Development Education (USDE) Program presented Mr. Edwards with the 2014 Individual Achievement Award. The Melvin Edwards Excellence Award established by the St. Kitts Co-operative Credit Union, has rewarded primary school students in his homeland for excellent test performances over the past seven years and Mr. Edwards has made personal donations to support more children with their educational goals.

Melvin Edwards is a graduate of the University of the West Indies (Cave Hill), the University of Wales (Swansea) and the Coady International Institute (Nova Scotia) and has authored numerous published articles and papers, drafted State policies, harmonized legislation for Caribbean jurisdictions and produced technical manuals on MSMEs, microfinance, credit unions and business associations. Residing in St. Lucia, he is married and is a father of four.

Inducted July 2023

Delores Glover is currently serving as chair of the Supervisory Committee of the Florida A&M University Federal Credit Union and has served on the committee for over 16 years. Ms. Glover recently returned to Florida A&M University (FAMU) after over 31 years with the University, of which she served in various areas. Ms. Glover created a new organizational approach to succession at FAMUFCU, and collaborated with NCUA, community leaders, state and local government to develop an impactful partnership that strengthens the opportunity for greater success. Ms. Glover is the founder of the recently established Historically Black Credit Union Foundation and managed $142 M in Higher Education Emergency Relief Funding for the University, Title III, Part B and F. Ms. Glover assisted the University in acquiring $126M in capital finance to build student dormitories. Ms. Glover recommended changes to the reauthorization of the Higher Education act that were approved and adopted by TMCF, UNCF and NAFEO.

Inducted July 2023

Anthony R. Grant was a proud credit union member for more than 22 years, with SRP Federal Credit Union as his primary financial institution for more than 18 years. He faithfully served SRP as a volunteer for 17 years, including the Board of Directors, Credit Committee, and Finance Committee.

His professional career included over 19 years of service at the Savannah River Site, where he handled multiple assignments. He was Manager, Contracts, Capital ,and Travel Accounting with Savannah River Nuclear Solutions. Mr. Grant applied the lessons learned from his varied experiences to his service as SRP board member. His knowledge and leadership skills were invaluable as the board sought to establish policies that would lead the credit union into the millennium during his tenure. Mr. Grant believed, “the opportunity to serve on the SRP Federal Credit Union Board of Directors representing this great membership is truly a rewarding experience.”

Mr. Grant made civic involvement a priority, which included serving the African-American Credit Union Coalition between 2000-2010 and leading multiple committees for the South Caroline State University National Alumni Association.

Mr. Grant was born and raised in Orangeburg, South Carolina. He was a graduate of South Carolina State University and received his MBA from Nova Southeastern University.

Inducted March 2015

Michael Hale, a U.S. Army veteran, has been devoted to the credit union movement since 1975.

He is a founding member of the African-American Credit Union Coalition and served as the Coalition’s 1st official Chairman.

Mr. Hale served on the Board of the Credit Union Executive Society (CUES) where he served diligently for a number of years. He served on the National Association of Federal Credit Unions Regulatory Affairs Committee, the National Federation of Community Development Credit Union’s Capitalization Program Committee and the Arizona Credit Union League’s Boards as well. Mr. Hale is also a member of the Filene Research Institute Council.

Mr. Hale served as CEO of Andrew’s Airforce Base FCU in Suitland, MD. The credit union grew to over $700 million in assets and expanded into underserved areas of Washington, DC under his leadership.

Inducted August 2015

Few people in the credit union movement have ever heard of Clarence Hall, Jr., Issaquena County and the credit union he founded 44 years ago.

Clarence Hall, Jr. (born 1924) was born raised and continues to live in Issaquena County in the Mississippi Delta. His ancestors were slaves and his parents grew up on a plantation. His mother passed away when he was only 11 years old.

Working in the fields most days, Clarence was unable to attend school very often. However, he brought his books home and read them at night by the light of a kerosene lamp. This inspired his travel to Washington, D..later in life to seek funding for an early childhood development program, known today as Head Start.

After hearing Clarence’s presentation, Senator Bobby Kennedy replied: “I have sympathy for the cause Mr. Hall, but YOU understand and know. I have never suffered for anything a day in my life.”

Despite his limited formal education, Clarence served on the Board of the Delta Area School District and currently serves as President of Western Line School Board. He strongly encouraged and promoted education in the county for all children. His daughter has four degrees and is the assistant principal at an elementary school in the Laurel Mississippi School District.

Clarence volunteered for service in the US Army where he served for 5 years during WWII. For three of those years, he served in the European Theater. After returning home, he spent four years in Agriculture School at Delta College. He eventually acquired 66 acres of land that he farmed for a living.

In 1957, Clarence was the first person in Issaquena County to pay the poll tax to be eligible to vote. He appeared before the U.S. Commission on Civil Rights and the Department of Justice to discuss abolishing the poll tax and literacy test as conditions to vote. During that time, only 5 out of 1,081 blacks were registered to vote. However, 100% of white residents in Issaquena County were registered.

As an Issaquena County native, Clarence made some of the first inquiries into an NAACP lawsuit against the Issaquena County Board of Education for the suspension of students wearing pro‐SNCC materials in 1965. Following the ruling in Blackwell v. Issaquena that black students in Issaquena and Sharkey Counties could not be prohibited from attending white schools, Clarence became a leader in registering black students for historically white public schools.

He was fired from his job at Atkin Saw Mill when he went to Washington to seek a grant for the Child Development Group of MS, the forerunner of the Headstart program. He serves on the Board of Directors. He fought to have the county and Congressional districts redrawn to allow blacks to be elected to public office, including the Issaquena County Board of Supervisors.

Clarence was also active in a number of local chapters of important rights organizations. He worked as Project Manager for the Delta Ministry, part of the National Council of the Church of Christ. He was particularly vital as an administrative assistant to the Freedom City project beginning in 1966, an affordable housing initiative that eventually failed.

Hall served as a key mover in implementing the Comprehensive Employment and Training Act (CETA). For 15 years, he was an Outreach Worker and Job Placement Specialist for the Mississippi Delta Council for Farm Workers. Clarence was forced to sue the State of Mississippi for denying blacks the right to obtain charters and set‐up non‐profit organizations.

In 1969, at the age of 45 – Clarence Chartered the Issaquena County FCU. Sitting along the Mississippi River just north of Vicksburg, Issaquena is the smallest county in the state. After the end of the Civil War, Issaquena County had the highest concentration of slaves in the nation. The county had approximately 12,000 residents, 95% of which were slaves. The other 5% were slave owners and their families.

The county population has decreased dramatically and steadily over the years. Since the chartering of the credit union in 1969, the population, which is the credit union’s field of membership, has decreased by 49%. Since 2000, the population decreased 39%. Today, there are fewer than 1,400 residents living in slightly more than 500 housing units.

Depending on the definition of poor, Issaquena is the 2nd poorest county in the nation. Over 45% of the county’s residents are living below poverty level. Per capita income is $10,581. Issaquena County FCU is the only financial institution for low income residents of the county.

There are no pawn shops, payday lenders, or finance companies. There is a bank branch where the credit union deposits money and members may cash their checks. Members obtaining loans at the credit union generally do not qualify for loans from the bank branch.

Because he knows and understands the people, for 44 Years, Clarence has served not only as Chairman of the Board, but also as President/CEO of the credit union. The NCUA has permitted Clarence to serve in both roles. The credit union simply would not be there without his leadership, commitment and vision.

For the first 36 years, Clarence did not receive a single dime for his service. During 44 years of making loans, the credit union has charged off less than $4,000 and never had as much as a penny come up missing. Issaquena County FCU – Last CU in MS to go on a computer system

In 2009, Clarence’s wife of 58 years passed away. His son, Clarence III, was being groomed to take over the credit union and he eventually talked his dad into going off the manual system. Unfortunately, the younger Clarence passed away in October, 2009 prior to the credit union conversion at year end. With the League’s assistance, the credit union still converted to a data processing system at the end of the year.

Then in early in 2010, Ora Lee Williams, the credit union’s bookkeeper for over 30 years also passed away. This would have been the end of most small credit unions, but Mr. Hall kept the credit union alive.

At the age of 89, Clarence still performs his roles as Chairman and CEO of the Issaque-na County FCU. The international proverb of the C.U.D.E program is exactly what Clarence has sought to achiever in Issaquena County. “Give a man a fish and you feed him for a day. Teach a man how to fish and you feed him for a lifetime.“

The success of the Issaquena County FCU comes from Clarence Hall’s knowledge of those he serves, and his philosophy: “Helping People Help Themselves.”

Throughout his life, Clarence Hall has been a dedicated servant to his God, his Country, his Church, his Family and fellow Mankind. He knows and understands suffering. In a variety of ways, he has dedicated his life to providing people an opportunity to improve their own well‐being!

Inducted August 2016

Bob retired in 2011 after 20 years as the President and CEO of the Seattle Metropolitan Credit Union. Born in Boston, Bob began his banking career in Los Angeles where he held senior positions with Bank of America, Wells Fargo Bank, and the Lockheed Federal Credit Union. When Bob and his wife moved from Pasadena, California to Seattle in 1992, they were very excited about their new life.

The move to Seattle turned out to be an excellent decision. Bob was recognized as Credit Union Executive of the year by the Credit Union Executives Society in 2003 and in 2004 he was added to the Credit Union Society’s hall of fame. During his career as SMCU CEO, he also served as Chairman of the Washington Credit Union League, Chairman of the Corporate Credit Union, Wescorp, and Chairman of the African American Credit Union Coalition.

In addition to his credit union career, Bob supported his community as a Seattle Police Department Reserve Officer from1994 until his retirement from SPD in 2015. He had been a patrol officer in SPD’s Gang Unit for 14 years. Previously he had patrolled for 10 years as a LA County Reserve Deputy Sheriff. Though retired as a patrol officer, Bob remains as a Tenor Drummer in the Police Department’s Pipes and Drums Band.

Bob currently serves as a Trustee and member of the Finance Committee for the $2Billion Seattle City Employees Retirement System. He is a board member for The Breakfast Group, an organization dedicated to keeping high school African American boys on the right path through an emphasis in education and social responsibility.

Bob has earned a BA in Mathematics and a MBA in Banking. After college, Bob felt the next step was to fulfill his military service. Bob joined the Marine Corps and graduated from Officer Candidate School as a 2nd Lieutenant. After graduation, Bob was assigned to language school for nine months to learn Vietnamese. Before beginning his overseas tour, he was promoted to 1st Lieutenant. He returned to the United States in 1971 and began his banking career. After his three years of active duty, Bob joined a Marine Corps Reserve Unit in Los Angeles and was promoted to Captain before ending his military career in 1979.

Bob and his wife live in Seattle and have four adult children and ten grandchildren. Bob’s wife is also a retired Credit Union Executive and they love to cruise and travel both nationally and internationally. When not travelling and spending quality time with their grandkids, they enjoy bike riding, old cars, and motorcycle touring.

Inducted August 2017

Inducted August 2017

Bert J. Hash, Jr., is the retired President and CEO of the Municipal Employees Credit Union of Baltimore (MECU), Inc., a position he held from December 1996 until June 2014. Mr. Hash was a seasoned financial services executive with over 44 years of experience in managing various aspects of banking and financial services. Before retiring from MECU, Bert worked for Equitable Bank for 15 years and Provident Bank of Maryland for 12 years.

Bert Hash received the Pete Crear Lifetime Achievement Award in 2014 and was inducted into the AACUC Hall of Fame in 2017.

Inducted August 2015

Rita L. Haynes retired as CEO of Faith Community United Credit Union (FCUCU) in Cleveland, Ohio after serving the credit union as a director with many volunteer duties from 1958 to May 2011. Asset of the fledging Mt. Sinai Baptist Church Credit union when she and her husband, James, volunteered to help were less than $1,000.00. Upon her departure as CEO in 2011 assets were over 10 Million dollars owned by over 5 thousand members.

Faith Community United Credit Union transitioned from a single church charter to a community development credit union in 1990 positioning it to have a paid staff and serve the entire county including the low income south side of Cleveland where all the banks had fled and payday lending had set up shop. Partnering with WECO they were successful in acquiring a modern bank branch building with ATM access and offer full service six days a week.

She credits God for giving her wisdom to seek out partnerships and collaborate with larger organizations such as the Cleveland Chapter, Ohio CU League, Inner City Association of Minority Credit Unions, National Federation of Community Development Credit Unions, WECO, CUNA, AACUC, NAACP and Urban League.

Serving as the first Faith based Credit Union chairman of NFCDCU in 1992 positioned her for election on the national scene. She was elected to the Federation board as alternate in 1992 and served as a director until 2008. Rita led the board as chair from 2001 to 2006 during which time they pioneered IDAs, VISTAs, CDFI Fund, The Capitalization Fund, Small Business Partnership and accredited school in partnership with Southern New Hampshire University and CUNA. She was in the first graduating class.

In Ohio she served as director pioneering the Ohio CU Foundation and has the distinction of having the small credit union program in Ohio branded The Haynes Circle upon her retirement.

AACUC honored her in 2005 with the Pete Crear Lifetime Achievement award. The CUNA Foundation’s Herb Wagner Award in 2008 highlighted her “Grace Loan” pay-day loan alternatives products.

Rita and James are blessed to have been married for 58 years. Their daughter Jama, MBA, is COO at FCUCU and Spelman College Alumni Chair. Son James is employed at USPO. His daughter, Dr. Lateira Haynes teaches in L.A. and son James III graduated as a welder.

"To GOD be the glory for the things he has done."

Inducted February 2023

Todd M. Harper was nominated to serve on the NCUA Board on February 6, 2019. The U.S. Senate confirmed him on March 14, 2019, and he was sworn in as a member of the NCUA Board on April 8, 2019. President Joseph R. Biden, Jr., designated him as the NCUA’s twelfth Chairman on January 20, 2021.

As NCUA Board Chairman, Mr. Harper serves as a voting member of the Financial Stability Oversight Council and represents the NCUA on the Federal Financial Institutions Examination Council and the Financial and Banking Information Infrastructure Committee.

Prior to joining the NCUA Board, Mr. Harper served as director of the agency’s Office of Public and Congressional Affairs and chief policy advisor to former Chairmen Debbie Matz and Rick Metsger. He is the first member of the NCUA’s staff to become an NCUA Board Member and Chairman.

Mr. Harper previously worked for the U.S. House of Representatives as staff director for the Subcommittee on Capital Markets, Insurance, and Government-Sponsored Enterprises and as legislative director and senior legislative assistant to former Rep. Paul Kanjorski (D-Pennsylvania). In these roles, he contributed to every major financial services law, from the enactment of the Gramm-Leach-Bliley Financial Services Modernization Act in 1999 through the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010.

During the Great Recession, Mr. Harper coordinated the first congressional hearing to explore the creation of a Temporary Corporate Credit Union Stabilization Fund. He also spearheaded staff efforts in the U.S. House to secure enactment of a law to lower the costs of managing both the Corporate Stabilization Fund and the National Credit Union Share Insurance Fund.

Mr. Harper led staff negotiations over several sections of the Dodd-Frank Act, including the Kanjorski amendment to empower regulators to preemptively rein in and break up “too-big-to-fail” institutions and proposals to enhance the powers of the Securities and Exchange Commission. He also developed the legislative framework for the bill that created the Federal Insurance Office to monitor domestic and international insurance issues.

Mr. Harper holds an undergraduate degree in business analysis from Indiana University’s Kelley School of Business and a graduate degree in public policy from Harvard University’s Kennedy School of Government.

Inducted August 2022

Inducted August 2022

Pamelya Herndon currently serves in the New Mexico House of Representatives as the strong voice for the residents of House District 28 in Albuquerque’s Northeast Heights. She also serves as the President/CEO of the

KWH Law Center for Social Justice and Change, a nonprofit law center focused

on providing access to justice for low and medium-income individuals with an emphasis on advocating for the rights of women, children, and families with children. Prior to opening KWH Law Center, Pamelya served as a Senior Trial Attorney with the Department of Treasury, Internal Revenue Service, as an Assistant Attorney General for New Mexico and as a Deputy Cabinet Secretary for the New Mexico General Services Department. Pamelya is a graduate of the Howard University School of Business and the University of Texas School of Law. She is admitted to practice law in the states of Colorado and New Mexico and before the United States Supreme Court. Pamelya is also licensed as a Certified Public Accountant.

Pamelya is a 2019-2021 W.K. Kellogg Fellow. She serves as a member of the Board of Directors of U.S. Eagle Federal Credit Union for twelve years. During her term on the Board, she has been a strong advocate for Members of Modest Means. Pamelya was instrumental in the establishment of a Credit Union Service Organization (CUSO) Program known as CU SAFE created to provide access to financial resources, at reasonable rate, for survivors of domestic violence.

Pamelya serves as the First Vice President of the NAACP, Albuquerque Branch, and as the Health Chair for the New Mexico State Conference of Branches of the NAACP. She also serves as a member of the Council of the Civil Rights and Social Justice Section of the American Bar Association (ABA), and as an appointed member of the ABA Commission on Domestic Violence and Sexual Assault.

As a part of her work with KWH Law Center, Pamelya has helped people of color have access to financial resources during the Covid-19 pandemic. Her work focused on helping ensure that no family was evicted from their home during the pandemic or loss access to utilities, as a result of a reduction in pay of loss of employment.

Recognizing that women of color are often not paid fairly as evidenced by Black Women’s Equal Pay Day occurring eight months after the end of the year; Native Women’s Equal Pay occurring nine months after the end of the year and Latina Women’s Equal Pay Day occurring ten months after the end of the year, Pamelya has been a champion of equal pay for women. She was a strong advocate for the Fair Pay for Women Act that became law in New Mexico in 2017.

Pamelya is the 2021 recipient of the Everyday Hero Award from the Office of African American Affairs, and she was awarded the Purple Ribbon Award in 2020 for her work in helping to provide financial resources for survivors of domestic violence. In addition, Pamelya has been recognized as the Public Lawyer of the Year by the Public Law Section of the New Mexico State Bar, as the Lawyer of the Year by the Albuquerque Bar Association and she has been featured in Essence Magazine, an international publication focused on the outstanding accomplishments of African American women. Pamelya occasionally hosts community focused programs on KUNM Public Radio, 89.9.FM, a National Public Radio (NPR) Affiliate in Albuquerque, NM.

Inducted July 2023

Rodney E. Hood currently serves as a Board Member for the National Credit Union Administration.

Immediately prior to rejoining the NCUA Board in 2019 as Chairman, Mr. Hood served as a corporate responsibility manager for JPMorgan Chase, managing national partnerships with non-profit organizations, financial regulators, and community stakeholders to promote financial inclusion and shared prosperity in underserved communities throughout the United States.

Mr. Hood served as a member of the University of North Carolina at Chapel Hill Board of Visitors and as member of the UNC School of Arts Board of Trustees. He also served as a member of the Board of Trustees for the North Carolina Museum of Art and as a member of the Board of Governors for the University of North Carolina College System.

Mr. Hood's professional awards include being named one of the “40 Young Leaders Under the Age of 40” by the Triangle Business Journal in Raleigh, North Carolina. He is also the first recipient of the “Dream Award,” an award given by the Wells Fargo Housing Foundation to honor individuals who have exhibited an outstanding commitment to affordable housing.

Inducted March 2018

Inducted March 2018

Hubert H. Hoosman, Jr. is the President of H&H Brokerage Group (Commercial), and Partner of Haywood Hoosman Realty (Residential). Hubert has been in the Credit Union Movement for over 31 years, he spent 19 of the years as President /CEO of Vantage Credit Union. During his tenure the credit union grew from 192 million to 718 million in assets. A national and international speaker for credit unions with topics including Board Development, Strategic Planning for Credit Unions, Fund Development and Building Teams that Inspire Loyalty and Trust. Hubert has been inducted in the Missouri Credit Union Hall of Fame, received the Herb Wagner Award and the Pete Crear Lifetime Achievement Award. Hubert has been a member of WOOCU, CUES, the Credit Union National Foundation and the National Federation of Community Development Credit Unions. He is a founding Board Member for the AACUC.

Inducted March 2015

Robert L. Jackson is a lifelong resident of Quitman County and has been employed with Quitman County Development Organization, Inc. (QCDO), since March 1977, of which he has served as the Chief Executive Officer since 1987. He also helped found the First Delta Federal Credit Union in 1981 and in 2009 it merged with the Shreveport Federal Credit Union serving the North Mississippi Delta. Shreveport total assets are approaching $105 million dollars to date. He has over 36 years of rural community economic development and philanthropic experience in rural Mississippi and the Mid-South.

Robert was elected to the Quitman County Board of Supervisors in 1987 after two unsuccessful attempts and served two terms until 1995. His first race was in 1979 two years after graduating from college. His slogan then as a young enterprising community servant was, “Old Enough to Know the Job, and Young Enough to Do it.” In November 2003, he was elected to the Mississippi State Senate, representing District 11, which includes Coahoma, Quitman, Tunica and Tate Counties. He serves on several committees including Chairman of the Executive Contingent Fund, Vice Chair of Labor, Appropriations, Energy, Ports and Marine Resources, Public Property, Agriculture and Business and Financial Institutions. He also serves as Treasurer for the MS Legislative Black Caucus.

He continues to serve on numerous non – profit boards of directors, both locally and regionally. Senator Jackson is a member of the board of Directors of Mississippi Action for Community Education (MACE), Foundation for the Mid-South, The Aaron E. Henry Community Health Services Center in Clarksdale, MS, and the Delta Burial Corporation (since 1996).

State Senator Jackson’s education includes a B.S. Degree in Business Administration from the University of Southern Mississippi and has done further studies at Delta State University and Antioch University of Yellow Stone, Ohio. He is a member of the Alpha Phi Alpha Fraternity, Member of Delta LISC Advisory Board, Stand UP for Rural America, NAACP, Southern Christian Leadership Conference, National Association of State Legislatures, and the Southern Legislative Conference.

In addition to being active in his community, Robert lends his leadership skills as an active member and Board of Deacon Ministry of Pleasant Hope Missionary Baptist Church of Lambert, MS, where he was born. He also takes advantage of volunteering opportunities. Robert is married to the former Gloria Richmond of Lambert of which they have a blended family of six (6) lovely children, Danielle, Nikara, Reginald, Lisa, Dametra and Zakiya.

Inducted August 2015

Shirley Jenkins has served as a member of MCU’s Board of Directors since 1983. Ms. Jenkins was the first female President in the Board’s history, as well as the Board Secretary for more than 30 years, a position she currently holds. Ms. Jenkins also served as the Legislative Chair for a number of years, working with legislative leaders regarding credit union issues. Ms. Jenkins was instrumental in implementing youth programs at MCU and serves on the Board of Trustees for employee pension plans.

After a long career in New York City service, Ms. Jenkins retired as a Director from Housing Preservation and Development in 1984. Ms. Jenkins was appointed to the National Directors Advisory Panel in 2006, and was inducted into the NYS Credit Union “Hall of Fame.” Ms. Jenkins was appointed to the New York Credit Union Foundation’s Board, and also is a founding member of the African-American Credit Union Coalition. Over the years, she has received many accolades and awards, including AACUC’s “Pete Crear Award.” Ms. Jenkins was also elected to the Credit Union Association of New York’s Board of Directors, representing credit unions with assets of more than $500,000. She has been involved in the community and political affairs for over 60 years and has received multiple honors in community service.

A graduate of the New Paltz Teachers College and the NYU and Cornell School of Industrial Labor Relations, Ms. Jenkins has five children, and is a proud grandmother, great grandmother, and foster parent.

Inducted July 2023

Adrian S. Johnson has been a member of the African American Credit Union Coalition (AACUC) since 2004. Adrian has served on the National Board since August 2015. In fact, he served as Chairman from August 2018 to August 2020 and led the AACUC in the Commitment to Change: Credit Unions Unite Against Racism Initiative with pledges over $1 million dollars. He has also served as Treasurer and Vice Chairman. He also co-chaired the Funding Development & Preservation Committee. In the past, Adrian has served as Co-Chair of the Internship Committee as well. He has also presented Asset/Liability Management at the AACUC National Conference. In addition, Adrian was a founding member of the AACUC - Eastern Regional Chapter which was established in December 2008, serving as parliamentarian. He has also served as vice president for the chapter. Adrian received the AACUC Board Chairman Award in 2014 for his loyal and dedicated to service to the organization.